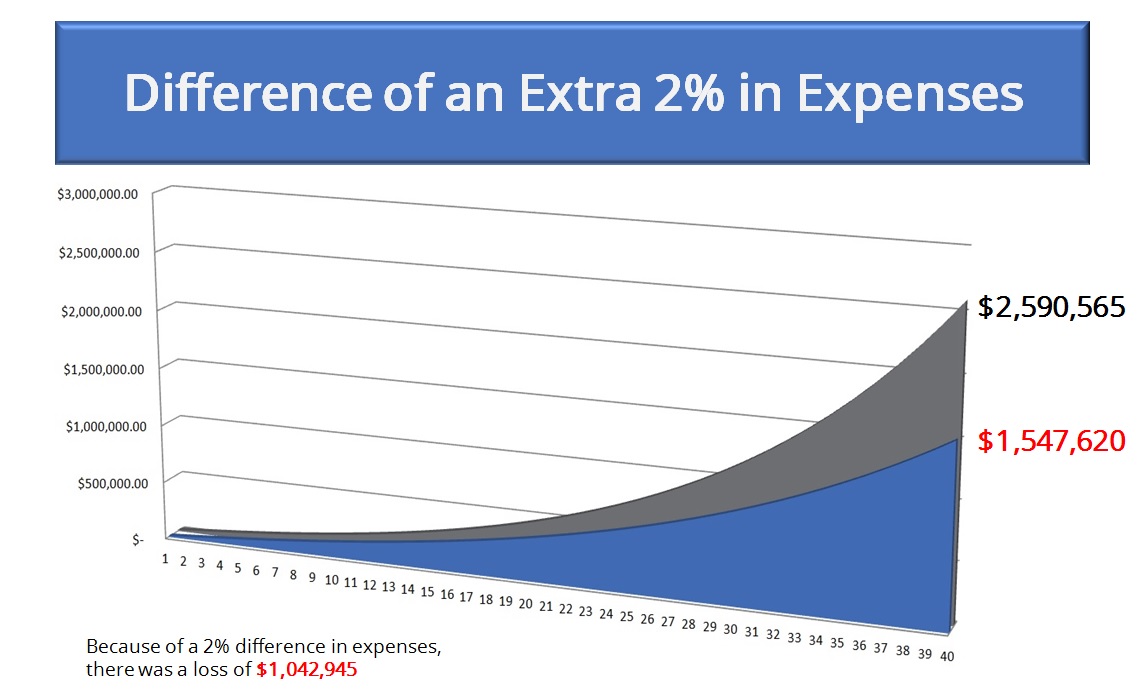

The cost of a portfolio can dramatically impact your overall return in the long run. Let's say that you invest $10,000 per year for 40 years. Lets assume that you can earn 9% on your portfolio year over year for 40 years. In the first situation you are charged 3% of assets under management by an advisor netting 6% return. In the second situation you are only charged 1% of assets under management by an advisor netting 8% return.

The results are extreme and show how important expenses are to a portfolio. In the first situation, the individual netting a 6% return ended up with $1,547,620 at retirement. In the second situation, the individual netting 8% return ended up with $2,590,565 at retirement. This is over a 40% difference in a compounding portfolio. This is why you should pay very close attention to expenses and costs associated with investing. There is very little you can control in a portfolio and your expenses are one of the items you can control.

Opinions expressed on this post are those of the author and may change over time and urge clients to seek professional adviser before making any financial planning or investment decisions.

Line graph showing the difference of 2% in expenses. Because of a the 2% difference in expenses, there was a loss of $1,042,945.